When we see shades of pink, our subconscious mind directly relates it with women. However, it

is not a big deal until this mindset leads to prejudice to one. A meme on haircuts circulates on

social media manifesting the before and after looks and its’ cost for both men and women. It is

funny until one realizes the difference in services which does not compliment the price gap. This

is not a mere accidental observation but the story behind ‘pink tax’!

Women make up 50% of the world population and hold a paramount position in the world

economy. Harvard Business Review on Female Economy highlights food, fitness, beauty,

apparel, health care, and financial services as the six most potential industries where women are

significant targets. So why are they compelled to pay more as consumers?

What is Pink Tax?

‘Tax’ is the charge levied by the concerned authorities on one’s income, goods or services. The

‘Pink Tax’ mentioned here is not actually a tax but a phenomenon of exorbitant prices on

products/services dedicated to women as compared to the same products for men, or gender

neutral ones. Hence, for people asking ‘Is the pink tax actually a tax?’, the answer is NO!

A man may wear the same suit the whole year going unnoticed but a woman will be pin-pointed

for wearing the same dress twice a week. That’s how the pink tax emerges meeting the demands

of variety for beauty.

How does ‘She’ pay more?

A study of gender pricing in Newyork reveals the gender based prices crashing women’s pockets.

Article on Women consumers by Forbes projects women as potential consumers. However the

market is biased against them. Even the government initially levied a GST of 12% on sanitary

napkins causing a stir among women and few PILs including Mohd. Israr Khan vs UOI which

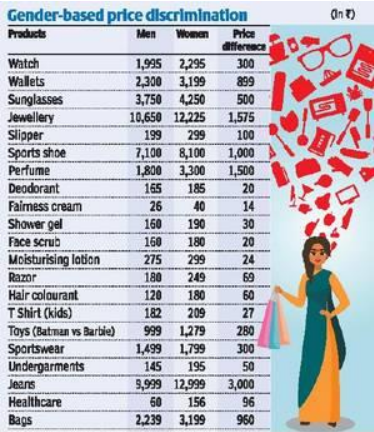

ensued the GST exemption on pads. The image below contains data collected by M. Geetha and

students from IIM Amritsar showing pink tax examples.

Pink Tax and Consumer Protection

The Consumer Protection Act, 2019 is the statute that protects the Indian consumers in case of

unfair trade practices. The Competition Act, 2002 restricts anti-competitive practices in the market and includes provisions related to product pricing as well. However, none of them directly deals with the gender based discrimination that prevails against goods and services for women.

How to get rid of Pink Tax?

Gender discrimination goes against Article 14 of the Indian Constitution. To curb this, women

consumers should not fall for pink tax products and filter gender neutral products. Behind the pink wraps, terms like gentle, sensitive, beautiful is the trap of pink tax. In an article on ‘Marketing to Women’ by American Express, it has much less to do with pink and more of a humanistic approach. If women consumers boycott products of gender based pricing and keep poking the concerned authorities in this regard, femininity may not remain costly